Criteria to suit more of your

near-mainstream residential borrowers?

Key criteria

Who for?

- Self-employed – directors, partners and contractors; retained profits considered

- Employed - no minimum term in current job (minimum 3 months employed)

- Clients with multiple and unusual income sources

- Holders of credit blips / lower credit scores - view our criteria tiers

- First time buyers

- Discover more about which extra-ordinary clients we can help you with here

How much?

- Maximum loan F1 & F2 £2m where product allows

- Maximum loan F3 & F4 £500k

- Maximum term 40 years

- Maximum age 75 at end of term

- No minimum income

- Maximum number of applicants is 4 (immediate family)

- Interest only, affordability calculated on an interest only basis up to 70% LTV

- Capital raising for buy to let purchase accepted

- A part and part mortgage up to 80% where product LTV allows

Income considered

- Up to 100% of bonus and/or commission accepted

- 100% Personal and state pension income

- 100% Investment income

- 100% Maintenance income (court order)

- 100% Maternity and paternity income

- 100% Trust income

- 100% of Land and Property income less the finance cost

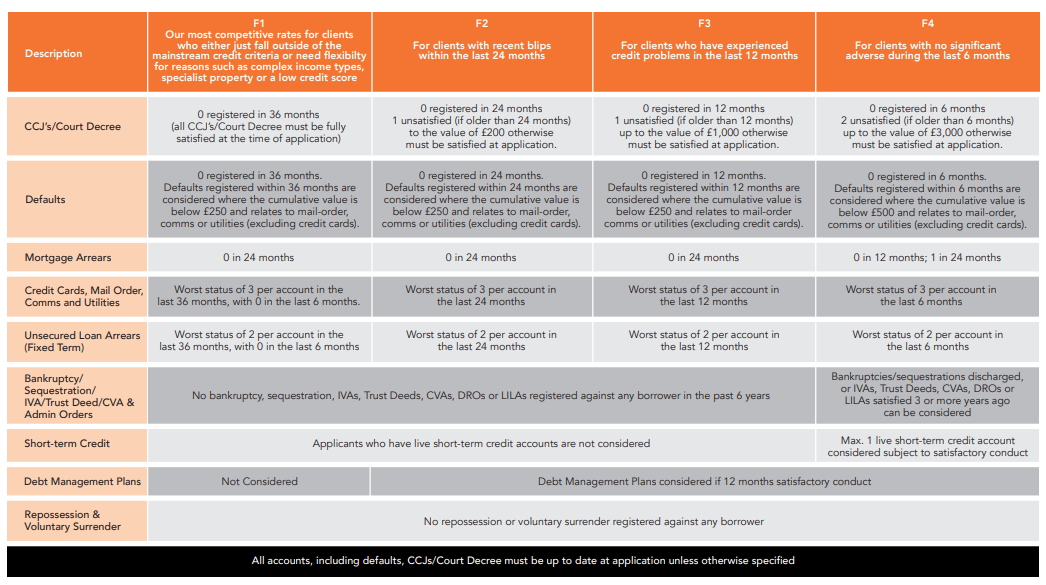

Our credit tiers explained

We consider clients with blips on their credit rating and other credit score declines. Our residential mortgages are split into four tiers, F1, F2, F3 and F4. Please use the table below to see which tier your client with a credit blip would fit into.